EZ Legal Fees provides the best bankruptcy lawyers in Maricopa. With our extensive expertise, we offer a range of specialized services to individuals and businesses struggling with overwhelming debt. This article will explore the various services and specialties provided by EZ Legal Fees, highlighting our commitment to helping clients regain financial stability.

An Introduction to EZ Legal Fees

You don’t have to struggle with debt alone! We understand that bankruptcy is not the solution for everyone, but we believe it can offer a vital fresh start for those burdened by overwhelming debt. We recognize that financial challenges can arise from various circumstances, and there is no shame in seeking relief through bankruptcy.

Our mission is to empower individuals and families to navigate this complex process with confidence and dignity. Our dedicated Arizona lawyers are committed to providing compassionate support and expert guidance every step of the way. We strive to make the bankruptcy process easy and painless, ensuring that our clients can eliminate debt and secure a brighter future for themselves and their loved ones.

You can trust that you have a strong advocate on your side, ready to help you achieve financial freedom and provide for your family’s needs. We offer totally free consultations seven days a week, at convenient locations across Maricopa County. Our attorneys are on your side!

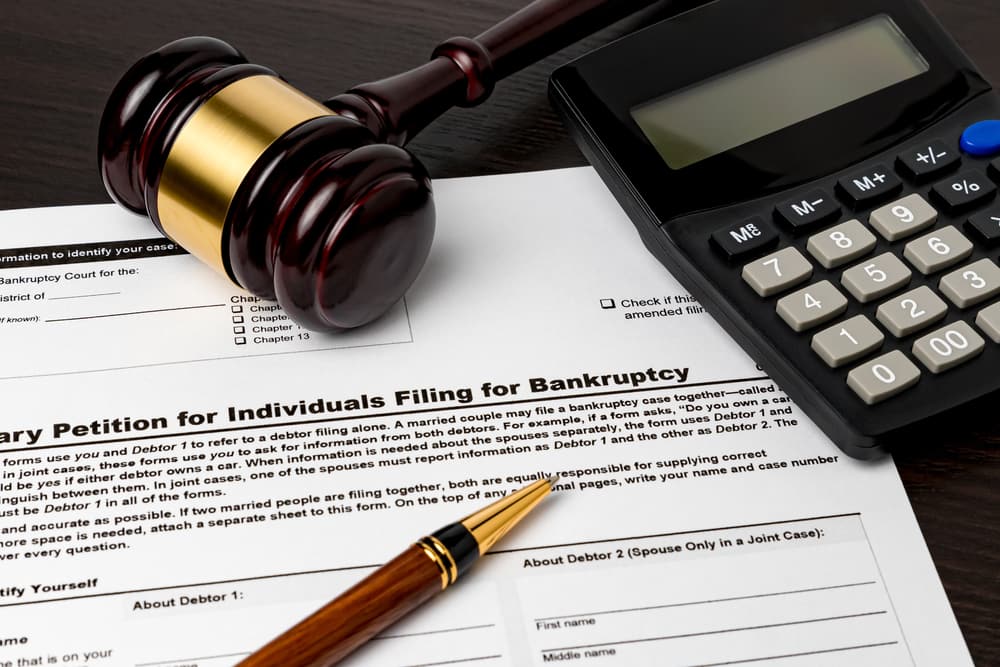

Explanation of Bankruptcy Laws and the Different Types of Bankruptcy Filings

The decision to file bankruptcy is never an easy one. This overview should give you a solid understanding of bankruptcy laws in Arizona and federally, as well as the various options available for individuals and businesses facing financial hardship.

Arizona and Federal Bankruptcy Laws

Bankruptcy laws in the United States encompass both federal regulations and state-specific statutes. In Arizona, as in all states, federal bankruptcy laws primarily govern bankruptcy proceedings. These laws provide individuals and businesses with legal mechanisms for managing overwhelming debt and obtaining financial relief.

The primary statutes governing bankruptcy in the United States are found in the United States Bankruptcy Code, which is a federal law enacted by Congress. This Code is divided into chapters, each outlining different types of bankruptcy filings and their respective processes. In addition to federal law, Arizona has its own set of laws that may influence bankruptcy proceedings within the state.

Different Types of Bankruptcy Filings

Chapter 7 Bankruptcy (Liquidation): Chapter 7 bankruptcy involves the liquidation of assets to pay off debts. It is typically available to individuals, married couples, partnerships, or corporations.

In a Chapter 7 bankruptcy, a court-appointed trustee sells the debtor’s non-exempt assets and distributes the proceeds to creditors. Many types of unsecured debt, such as credit card debt and medical bills, can be discharged through Chapter 7. Certain assets, such as primary residences, vehicles up to a certain value, and necessary personal belongings, may be exempt from liquidation under state or federal law.

Chapter 13 Bankruptcy (Reorganization): Chapter 13 bankruptcy involves creating a repayment plan to reorganize debt over a period of three to five years. Individuals with a regular income who have debts below certain thresholds may opt for Chapter 13 bankruptcy. This allows debtors to keep their property and repay creditors through a court-approved plan.

Chapter 13 can be advantageous for individuals facing foreclosure or repossession, as it allows them to catch up on missed payments over time.

Understanding the nuances of each type of bankruptcy filing is crucial for individuals and businesses considering bankruptcy as a debt relief option. Consulting with a knowledgeable Phoenix bankruptcy lawyer can help debtors navigate the complexities of the bankruptcy process and make informed decisions regarding their financial future.

Why is it Important to Hire a Skilled Bankruptcy Lawyer?

Hiring a skilled bankruptcy lawyer is crucial for several reasons:

A Bankruptcy Attorney Has Expertise in Bankruptcy Law

Bankruptcy law is complex and constantly evolving. A knowledgeable Maricopa County attorney understands the intricacies of both federal and state bankruptcy laws, as well as the specific rules and procedures of the bankruptcy court. They can navigate the legal system effectively on behalf of their clients, ensuring that their rights are protected and that they receive the full benefits available under the law.

Bankruptcy Attorneys Provide Tailored Advice and Guidance

Every individual or business facing financial difficulties has a unique set of circumstances. A skilled bankruptcy lawyer can assess their client’s situation, explain the options available to them, and recommend the most appropriate course of action. Whether it’s filing for Chapter 7 or Chapter 13, an attorney can provide personalized guidance that aligns with their client’s goals and financial interests.

Filing Bankruptcy With a Bankruptcy Lawyer in Maricopa Provides Protection from Creditor Harassment

One of the immediate benefits of hiring a bankruptcy lawyer is that it puts an end to creditor harassment. Once a bankruptcy petition is filed, an automatic stay goes into effect, preventing creditors from taking further collection actions, such as calling, sending letters, or initiating lawsuits. An attorney can handle all communications with creditors on behalf of their client, relieving them of the stress and pressure associated with debt collection efforts.

Hiring AZ Lawyers Prevents You From Making Costly Mistakes

Bankruptcy proceedings involve numerous legal and procedural requirements. Failing to adhere to these requirements can result in delays, additional expenses, or even dismissal of the case. A skilled bankruptcy lawyer understands the potential pitfalls of the bankruptcy process and can help their clients avoid costly mistakes. From completing paperwork accurately to attending court hearings, an attorney ensures that everything is done correctly and efficiently.

Maricopa County Bankruptcy Lawyers Help You Maximize Your Debt Relief

The ultimate goal of bankruptcy is to provide individuals and businesses with a fresh financial start by eliminating or restructuring debts. A skilled bankruptcy lawyer works to maximize their client’s debt relief while safeguarding their assets to the fullest extent possible. Whether through negotiation with creditors, exemption planning, or strategic use of bankruptcy laws, an attorney strives to achieve the most favorable outcome for their client.

In summary, hiring a skilled bankruptcy lawyer from EZ Legal Fees is essential for obtaining effective legal representation, tailored advice, and protection throughout the bankruptcy process. With our team’s expertise and guidance, individuals and businesses can navigate the complexities of bankruptcy with confidence and secure a brighter financial future.

Better Understand The AZ Bankruptcy Process

When you need us, our bankruptcy attorneys are here. We are with you every step of the process and beyond. From the moment you reach out to us seeking a solution to life after bankruptcy, our team is ready to offer guidance, support, and sound counsel.

Navigating the bankruptcy process in Maricopa County, Arizona, involves a series of legal steps designed to assist individuals and businesses facing insurmountable debt. The United States Bankruptcy Court for the District of Arizona handles these cases with the goal of providing a fresh start for debtors while ensuring fair treatment of creditors. The process can vary depending on the type of bankruptcy filed, whether it’s Chapter 7 or Chapter 13, each tailored to different financial situations and outcomes.

Understanding the local rules and procedures is crucial for debtors pursuing bankruptcy in Maricopa County. They must comply with both federal and Arizona state laws, including the means test, credit counseling requirements, and exemptions that may protect certain assets from liquidation. Debtors begin by submitting a petition along with a series of financial documents outlining their assets, liabilities, income, and expenses.

Throughout the bankruptcy process, debtors may interact with various parties, including trustees, judges, and creditors. Trustees oversee the case to ensure assets are appropriately managed and creditors receive due process. Automatic stay provisions take effect upon filing, halting most collection activities against the debtor. This legal respite allows debtors to work through their financial restructuring or liquidation under the court’s supervision without the immediate pressure of impending collections, foreclosures, or lawsuits.

Understanding Bankruptcy in Maricopa County

Bankruptcy proceedings in Maricopa County adhere to federal laws while incorporating Arizona-specific regulations. It’s critical for debtors to understand the different types of bankruptcy available and the eligibility criteria required to file in this jurisdiction.

Types of Bankruptcy

While there are technically several options, most individuals and businesses primarily file for two types of bankruptcy, Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy:

- Description: Liquidation bankruptcy that allows for the discharge of most debts.

- Suitable for: Individuals who do not have a significant income and who cannot repay their debts.

- Primary Feature: Assets may be sold by a trustee to pay creditors.

Chapter 13 Bankruptcy:

- Description: Reorganization bankruptcy designed for individuals with regular income.

- Suitable for: Individuals who wish to keep their assets and repay their debts over a three- to five-year period.

- Primary Feature: Debtors propose a repayment plan to make installments to creditors.

Eligibility Criteria

Eligibility for filing bankruptcy in Maricopa County requires careful consideration of legal and financial factors.

Chapter 7 Eligibility:

- Means Test: Applicants must pass the Means Test, comparing their income to the median income in Arizona.

- Credit Counseling: Debtors must complete credit counseling from an approved agency within 180 days before filing.

Chapter 13 Eligibility:

- Debt Limits: Unsecured debts must be less than $394,725 and secured debts less than $1,184,200.

- Regular Income: Applicants must have a regular income to create a viable repayment plan.

The Bankruptcy Filing Process

The bankruptcy filing process in Maricopa County, Arizona, involves detailed preparation, mandatory credit counseling, and the actual filing of the petition with the bankruptcy court.

Preparing Your Documents

Individuals must gather financial records including lists of assets, debts, income, and expenses. Documentation is critical for the accuracy of the bankruptcy petition. Common forms include:

- Tax returns: Past two years’ federal and state returns

- Income documentation: Pay stubs or profit-and-loss statements

- Asset documentation: Titles for properties and vehicles

- Debt statements: Recent statements from creditors

- Financial transactions: Records of major financial transactions in the past two years

Credit Counseling Requirement

Before filing for bankruptcy, individuals are required to complete a credit counseling course from an approved agency within 180 days prior to the filing date. This must include:

- Evidence of completion: The counseling agency provides a certificate as proof.

- Approved agency: The course must be taken through an agency approved by the US Trustee Program.

Filing the Petition

The bankruptcy process officially begins when the individual files a petition with the bankruptcy court. The key stages include:

- Submitting forms: You will submit your completed bankruptcy forms, including Schedules, Statement of Financial Affairs, and Means Test.

- Paying fees: The filing fee must be paid or a fee waiver application submitted.

- Automatic stay: Filing the petition triggers an automatic stay, stopping most collection actions against the debtor.

Post-Filing Procedures

Once a bankruptcy case is filed in Maricopa County, AZ, specific procedures follow that are critical for the debtor and creditors alike. The debtor will need to attend a 341 Meeting of Creditors, work with a bankruptcy trustee, and understand the debt discharge process.

341 Meeting of Creditors

The 341 Meeting of Creditors, also known as the creditors’ meeting, usually occurs within 20 to 40 days after filing for bankruptcy. The debtor is required to attend this meeting, where creditors can ask questions about the debtor’s financial affairs and the bankruptcy forms submitted. It’s presided over by the bankruptcy trustee and not by a judge.

- Date and Time: Scheduled by the trustee

- Location: Specified by the court

- Purpose: To allow creditors to question the debtor under oath

Bankruptcy Trustee’s Role

Upon filing, the court appoints a bankruptcy trustee to oversee the case. The trustee’s primary role is to review the bankruptcy petition, supporting documents, and to administer the bankruptcy estate.

Responsibilities:

- Asset Management: Identify and oversee assets

- Meeting Conduct: Preside over the 341 Meeting

- Claims Evaluation: Review creditor claims and object when necessary

Debt Discharge Process

The debt discharge process is the concluding phase where the debtor is released from liability for certain debts. Not all debts are dischargeable. This process varies by the chapter of bankruptcy filed—Chapter 7 often results in a quicker discharge than Chapter 13.

Criteria:

- Eligibility: Determined by type of debt

- Completion: Requires fulfilling all court mandates

Outcome:

- Debt Relief: Debtor receives a discharge notice

- Permanent Injunction: Creditors prohibited from collection actions on discharged debts

Life After Bankruptcy

Life after bankruptcy in Maricopa County, AZ involves a careful approach to rebuilding financial stability. Individuals focus on reestablishing their credit and managing their finances over the long term.

Rebuilding Credit

After a bankruptcy discharge, individuals should monitor their credit reports to ensure accuracy. A secured credit card can serve as an effective tool in beginning to rebuild credit. It requires a deposit that typically becomes the credit limit. Payment history is crucial; timely payments contribute positively to a credit score. An installment loan, like an auto or personal loan, when repaid responsibly, can further aid in credit rehabilitation.

- Obtain a secured credit card

- Regularly monitor credit reports for errors

- Consider a cosigner for new credit applications

- Keep credit utilization ratio low (<30%)

- Pay all bills on time

Long-Term Financial Management

Post-bankruptcy, individuals should devise a realistic budget to control their spending and save money. Developing an emergency fund prevents reliance on credit during unexpected financial situations. They must also consider consulting with a financial advisor to formulate a long-term financial plan, involving retirement planning and debt management strategies.

- Budgeting: Track income and expenses meticulously.

- Savings: Aim to save at least three to six months’ worth of living expenses.

- Financial Planning: Seek professional advice for investment and saving for retirement.

- Debt Management: Avoid incurring new debts; use credit wisely.

Common Misconceptions and Myths About Bankruptcy

Bankruptcy is often shrouded in myths and misconceptions, leading to a misunderstanding of the process and its implications. It is commonly seen as a last resort for people facing financial ruin. However, the reality of bankruptcy is more complex and nuanced. Many believe that declaring bankruptcy will permanently ruin their credit or that all debts can be wiped clean. Both of these beliefs are inaccurate. Bankruptcy is a legal proceeding that can provide a fresh start for individuals and businesses overwhelmed by debt, but it’s not a one-size-fits-all solution.

Understanding bankruptcy starts with differentiating between the types, primarily Chapter 7 and Chapter 13 for individuals, each with distinct processes and outcomes. Misconceptions about the loss of all personal property or the ability to discharge all forms of debt are widespread. Contrary to popular belief, certain assets may be protected in bankruptcy, and some types of debts, like student loans or alimony, are often not dischargeable. Education on bankruptcy can offer a clearer perspective on what it can and cannot do, highlighting that it may be a path to debt relief, but it carries long-term financial and legal consequences.

The complexities surrounding bankruptcy extend to its impact on credit and personal finances. It is believed that a bankruptcy filing universally leads to an inability to obtain future credit, but this overlooks the nuances of how credit scores are affected and rebuilt over time. Although bankruptcy can stay on a credit report for up to 10 years, individuals can often start rebuilding credit soon after. It’s essential for individuals to understand the rigorous requirements for filing, the involved legal processes, and the importance of considering all other financial options before deciding that bankruptcy is the appropriate course of action.

Bankruptcy as a Failure

Bankruptcy is often misconstrued as an end to financial stability. Let’s clarify the common myths surrounding bankruptcy and address the associated social stigma.

Misconceptions of Bankruptcy as Financial Ruin

Many individuals believe that declaring bankruptcy leads to irreversible financial damage. However, this is not inherently true. Bankruptcy can be a strategic decision, enabling debt discharge and offering a path to rebuild credit over time. Post-bankruptcy, individuals can obtain new lines of credit, often within a few years, debunking the myth that credit is permanently inaccessible.

The Stigma Associated with Bankruptcy

The stigma of bankruptcy is pervasive, yet not wholly accurate. Bankruptcy is frequently viewed as a personal failure, rather than a legal tool that offers protection from creditors. In truth, successful individuals and businesses often use bankruptcy as a means to reorganize debts and protect assets, highlighting its function as a viable financial strategy.

The Inevitability of Debt Discharge

In bankruptcy, the discharge of debt is not guaranteed and varies according to individual circumstances and the type of bankruptcy filed.

Beliefs About Automatic Debt Elimination

Many individuals mistakenly believe that filing for bankruptcy will automatically erase all their debts. However, this is not universally true for several reasons: Certain debts, such as student loans, alimony, child support, and certain taxes, are typically non-dischargeable. As well, Chapter 7 and Chapter 13 treat debt differently. Chapter 7 may discharge most debts, but Chapter 13 involves a repayment plan.

Understanding Partial Debt Repayment

The concept of partial debt repayment is crucial in bankruptcy, especially under Chapter 13:

- Repayment Plan: Debtors repay a portion of their debts over a 3-5 year period based on their income and debt amounts.

- Means Test: This determines eligibility and the extent of debt repayment required.

- Debts that Remain: After the repayment period, some remaining unsecured debts may be discharged, depending on the case.

Bankruptcy Process and Consequences

Bankruptcy is a legal process with significant repercussions, typically contrary to the perception of it as an effortless debt solution. It involves a series of steps and has long-term effects on an individual’s financial status.

Expectations of a Quick and Easy Process

Many individuals mistakenly believe that filing for bankruptcy provides an immediate resolution to their financial problems. However, the bankruptcy process can be complex and time-consuming. It requires thorough documentation, including a detailed list of assets, liabilities, income, and expenses. Credit counseling and debtor education courses are mandatory before the completion of the process. A typical Chapter 7 bankruptcy can take about four to six months, whereas Chapter 13 bankruptcy usually spans three to five years due to the payment plan involved.

Long-Term Impacts on Credit History

A bankruptcy can remain on an individual’s credit report for 7 to 10 years depending on whether they filed Chapter 13 or Chapter 7 bankruptcy, respectively. This notation can significantly lower credit scores, making it more challenging to obtain loans, credit cards, and even influence housing and employment opportunities. It’s worth noting the impact varies:

Chapter 7 Bankruptcy remains for 10 years on a credit report.

Chapter 13 Bankruptcy remains for 7 years on a credit report post-discharge.

Rebuilding credit after bankruptcy is possible, but it requires consistent financial discipline and careful management of new credit obligations.

Effects on Employment and Future Opportunities

Filing for bankruptcy can impact one’s employment and future financial opportunities. However, the real effects often depend on individual circumstances and the type of bankruptcy filed.

Job Prospects Post-Bankruptcy

Many employers perform credit checks as part of their hiring process. While federal law prohibits employers from discriminating against applicants because they have filed for bankruptcy, this does not apply to private companies. List of potential impacts on job prospects:

- Public Sector: Generally, filing for bankruptcy won’t disqualify someone from obtaining a government job.

- Private Sector: Some private sector employers may consider a candidate’s credit history as part of their evaluation process.

- Financial Industry: In fields such as banking or finance, bankruptcy may be scrutinized more closely because of the nature of the work involving fiscal responsibility.

Access to Future Loans and Credit

Post-bankruptcy access to loans and credit can be challenging, but not impossible. The individual’s credit score will initially suffer, but it can be rebuilt over time. Post-bankruptcy, individuals may be more likely to qualify for secured credit cards to start rebuilding credit. However, interest rates for loans may be higher, and terms less favorable.

As stated above, a Chapter 13 bankruptcy remains on one’s credit report for seven years, while Chapter 7 stays for 10 years. Access to credit improves gradually as the individual demonstrates fiscal responsibility.

Trust the Arizona Bankruptcy Lawyers at EZ Legal Fees

In a time where financial challenges are commonplace, individuals and businesses often find themselves in need of experienced legal assistance to navigate the complexities of bankruptcy. Opting for bankruptcy can be a critical decision, with long-term implications for one’s financial future. The bankruptcy attorneys in Phoenix at EZ Legal Fees are recognized for providing transparent and manageable legal solutions tailored to the unique situations of their clients.

With a genuine understanding of the stress and uncertainty that accompanies financial distress, our lawyers prioritize clear communication and a thorough explanation of all available options. We offer a comprehensive approach to addressing debt, advising on whether to pursue payment plans or file for bankruptcy, and guiding clients through every step of the process. Our commitment to making bankruptcy services accessible is evident in our flexible payment structures and free consultations, designed to alleviate additional financial burdens.

Moreover, the legal team at EZ Legal Fees ensures that clients are well-informed about the procedural aspects of bankruptcy filings in Arizona. A Chapter 7 bankruptcy lawyer in Maricopa or Chapter 13 bankruptcy lawyer in Maricopa will assist in gathering financial documents, completing required courses, and meticulously filing the necessary paperwork, all while maintaining the highest levels of accuracy and compliance with relevant laws. Our sustained track record of assisting clients to regain control of their finances speaks to their capability and reliability in the field of bankruptcy law.

Why Choose EZ Legal Fees for Bankruptcy

When considering bankruptcy in Arizona, EZ Legal Fees offers a specific combination of expertise and personalized care that makes them stand out. We ensure that each client receives a tailored solution that best fits their unique financial situation.

Personalized Bankruptcy Solutions

EZ Legal Fees takes a personalized approach to bankruptcy. We understand that each client comes with a different set of financial challenges and opportunities. Therefore, clients can expect to receive individualized attention and a customized plan to navigate their bankruptcy effectively.

Understanding Bankruptcy Law

The attorneys at EZ Legal Fees are not only well-versed in Arizona’s bankruptcy laws but also stay informed about the latest changes and trends. We provide their clients with a clear understanding of their options and the implications of each type of bankruptcy. We ensure that clients have all the necessary information to make an informed decision about their financial future.

Legal Fees and Payment Options

Understanding the cost of legal services is a critical factor for individuals considering bankruptcy. The Arizona Bankruptcy Lawyers at EZ Legal Fees offer transparent fee structures, flexible payment options, and access to affordable legal assistance, ensuring that financial relief is within reach. It is our belief that cost should not be a barrier to obtaining legal representation, especially for those seeking a fresh financial start through bankruptcy.

Fee Structure for Bankruptcy Services

EZ Legal Fees provides straightforward and competitive pricing for bankruptcy services. We offer detailed breakdowns of costs, ensuring that clients are fully aware of the fees associated with filing for bankruptcy. Costs may include court filing fees, attorney fees, and any additional charges that might apply to an individual’s case.

Flexible Payment Plans

Our approach is client-centered, prioritizing the provision of legal services in a way that alleviates additional financial stress. When you hire us you can expect:

#1 Free Consultation This is a free-of-charge initial consultation, allowing clients to understand their options without any financial commitment.

#2 Payment Schedule Clients can opt for installments, making legal services more manageable from a financial standpoint.

#3 Personalized Agreements Each client’s financial situation is addressed with tailored payment plans that suit their unique circumstances.

Facing a mountain of debt can bring crippling fear, overwhelm, and anxiety, overshadowing every aspect of your life and stealing your happiness. As leading bankruptcy attorneys in Arizona, EZ Legal Fees is dedicated to helping you take back control of your life by managing your debt, whether through a payment plan or filing bankruptcy if appropriate. We can help you understand the options available to you.

Our Clients’ Testimonials

Arizona Bankruptcy Attorneys With 5-Star Rated Reviews

Easy process and we filed the same day. What a difference it has made in our life. We started rebuilding our credit the very next month with their payment plan! I’m happy, my husband is happy, and we owe it to EZ Legal Fees by WantAFreshStart.

100% Guaranteed Client Satisfaction

Frequently Asked Questions About Bankruptcy Law